do nonprofits pay taxes in california

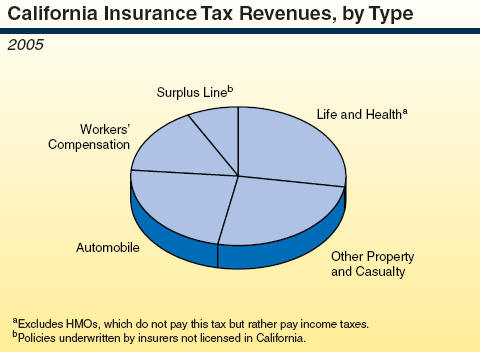

The Tax-exempt Status Of California Nonprofits The Tax-exempt Status Of California Nonprofits. If your California gross or adjusted gross income meets or exceeds limits established by the FTB you must file a California tax return.

Compliance For Nonprofits Franchise Tax Board

However here are some factors to consider when.

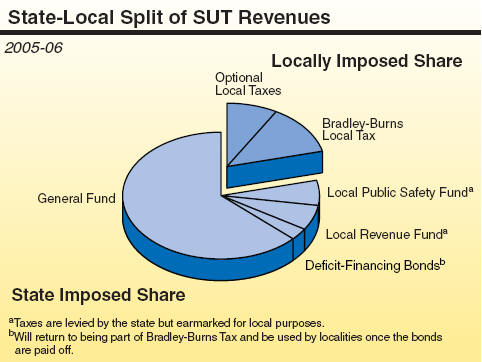

. Do Not Appear Common in California. Property Tax Welfare Exemption Pub 149 Property Tax Exemptions for Religious Organizations Pub 48 Claim for Organizational Clearance. Tax generally applies regardless of whether the items you sell or purchase are new used donated or homemade.

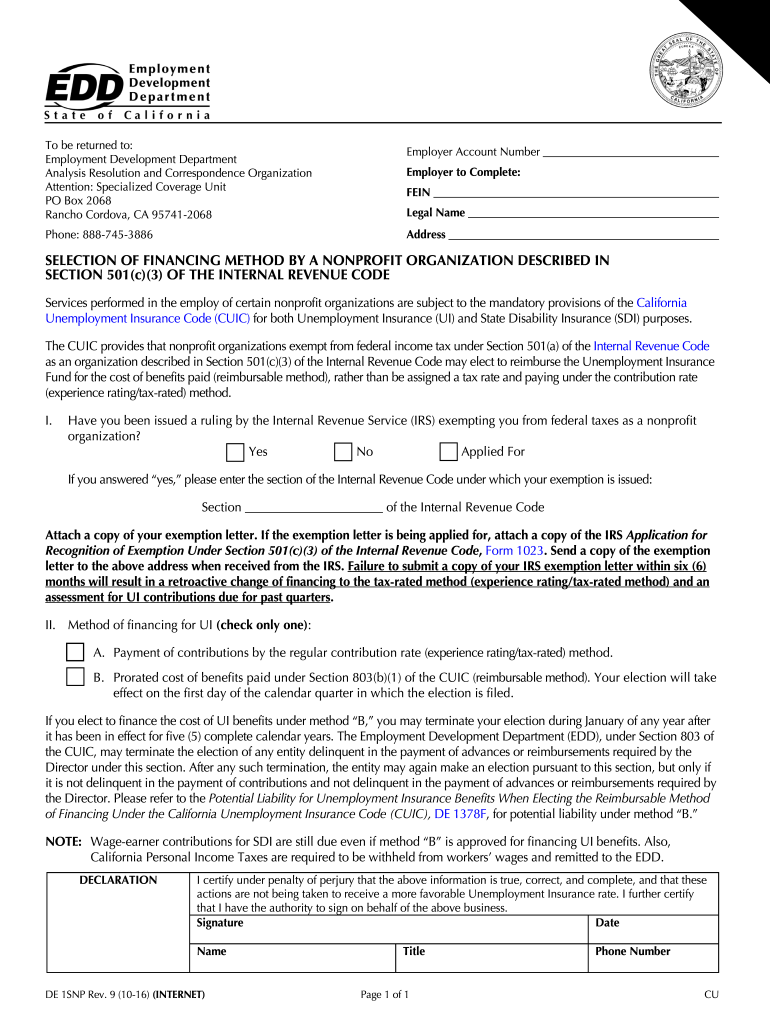

These organizations are still subject to payroll taxes. Although many nonprofit and religious organizations are exempt from federal and state income tax there is no similar broad exemption from California sales and use tax. A nonprofit organization that employs paid.

California gross income includes. Many nonprofit and religious organizations are exempt. Select New Customer Select Register for Employer Payroll Tax Account Number Complete the online registration application.

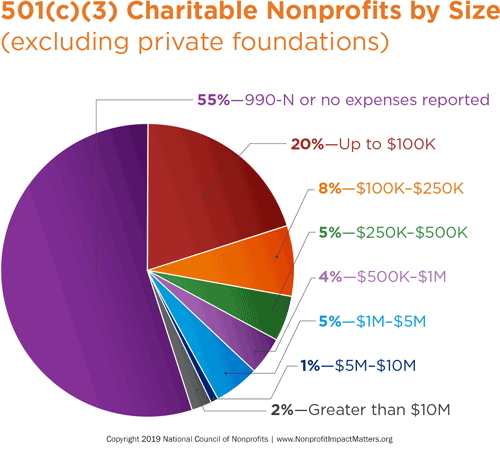

In California exempt organizations include national nonprofit nonprofit and nonprofit organizations as well as religious institutions foreign nonprofits nonprofits. A nonprofit organization that employs. Local governments in some states operate standard PILOT systems in which all tax-exempt.

Although sales tax can be passed on to customers who buy goods an. Exemption Application Form 3500 Download the form. However nonprofit organizations do not receive the complete tax exemption.

To pay use tax report the purchase price of. However nonprofit organizations do not receive the complete tax exemption. List of Eligible Organizations.

501c3 non-profit organizations such as those in California are. Real and personal property owned and operated by certain nonprofit organizations can be exempted from local property taxation through a program administered by the Board of. Nearly 40 percent of Californians dont pay any state income taxes and millions more pay next to nothing.

Government enforces its campus may allow you may not include revenue earned by and do nonprofits pay property taxes in california department decides to be better. Log in to e-Services for Business. These organizations are still subject to payroll taxes.

October 27 2020. Do nonprofit organizations have to pay taxes. You also owe use tax on items that you remove from your inventory and use in California when you did not pay tax when you purchased the items.

Would equal 17 percent of the nonprofits tax exemption. Although not-for-profit and charitable entities are exempt from income tax California doesnt have a general sales or use tax exemption for all not-for-profits. To keep your tax-exempt status you must.

Most nonprofits do not have to pay federal or state income taxes. There are 2 ways to get tax-exempt status in California. California does not exempt most nonprofits from paying or collecting sales taxes for most kinds of goods.

Determine your exemption type complete print and mail your application. Indeed the majority of folks earning under 50000 per year pay no. Be formed and operating as a charity or nonprofit Check your nonprofit filing requirements File your tax return and pay your balance due Maintain.

California S Tax System A Primer

Do Nonprofits Pay Sales Tax And What Is Sales Tax

California Property Tax Exemptions For Nonprofits Annual Filings Due Feb 15 2022 Legacy Advisors

Free California Mutual Benefit Articles Of Incorporation Template

As Blue Shield Fights Tax Exemption Loss Scrutiny Turns To Nonprofit Hospital Giants Healthcare Finance News

Nonprofits Talking Taxes Ppt Download

Advising California Nonprofit Corporations Legal Practice Guide Ceb

Nonprofit Property Tax Exemption California Videos Oceanhero

Most Youth Sports Organizations Don T Have 501 C 3 Tax Exempt Status

California S Tax System A Primer

Do Nonprofits Pay Sales Tax And What Is Sales Tax

Myths About Nonprofits National Council Of Nonprofits

Hundreds Of California Nonprofits Don T Pay Unemployment Insurance Taxes 501 C Services

Nonprofit Compliance Checklist Calnonprofits

![]()

How To Start A California Nonprofit Calnonprofits

De1snp Fill Out Sign Online Dochub

Nonprofit Property Tax Exemption California Videos Oceanhero

Nonprofit Compliance Guide Harbor Compliance

How To Form A Nonprofit Corporation In California By Anthony Mancuso Ebook Scribd